Cryptocurrency for Digital Nomads: Is It a Good Investment?

In an era where flexibility and autonomy define the working lives of digital nomads, the integration of cryptocurrency into everyday transactions and investments is becoming increasingly appealing. The concept of a decentralized digital currency, free from the constraints of traditional banking systems, aligns seamlessly with the nomadic lifestyle. However, the question arises: Is cryptocurrency for digital nomads a good investment? Understanding the nuances of this financial tool is essential for those who are constantly on the move and looking to maximize their financial freedom.

Transitioning into the digital realm offers many advantages, especially for those who traverse the globe. The ability to carry out transactions without the need for a physical bank, avoiding the limitations of exchange rates and international fees, can be a game changer. Yet, with every advantage comes a set of challenges that should not be overlooked. As digital nomads consider embracing cryptocurrencies, they must weigh the potential benefits against the inherent risks.

In this exploration, we’ll delve into the advantages of using cryptocurrency for transactions and investments, as well as the risks that come with this volatile market. By understanding both sides of the coin, digital nomads can make informed decisions that align with their unique lifestyle and financial goals.

The Advantages of Cryptocurrency for Digital Nomads

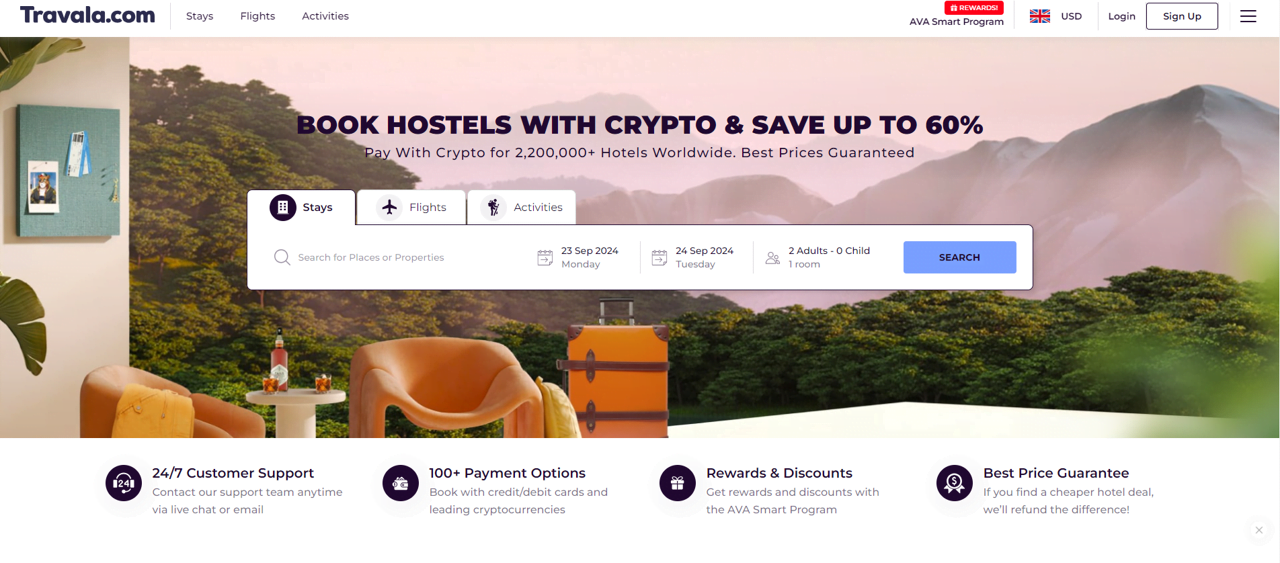

One of the most compelling reasons for digital nomads to consider cryptocurrency is its decentralized nature. Unlike traditional currencies, cryptocurrencies operate on a global scale without the need for intermediaries such as banks. This allows for seamless transactions across borders, enabling digital nomads to avoid the high fees associated with currency exchange and international bank transfers. Additionally, the ability to access funds from anywhere in the world with just an internet connection provides an unprecedented level of financial freedom.

Another significant advantage is the potential for high returns on investment. Cryptocurrencies like Bitcoin and Ethereum have demonstrated substantial growth over the past decade, making them attractive options for those looking to invest. For digital nomads, who may have limited opportunities to invest in traditional assets due to their transient lifestyle, cryptocurrencies offer an alternative that can be managed entirely online.

Furthermore, anonymity and privacy are key features of cryptocurrency transactions. For digital nomads who value their privacy, the ability to make purchases and transfers without revealing personal information can be highly appealing. This level of privacy can be particularly beneficial when operating in countries with strict financial regulations or when trying to avoid unnecessary bureaucratic hurdles.

The Risks Involved in Cryptocurrency for Digital Nomads

Despite the numerous benefits, cryptocurrency comes with significant risks, especially for those unfamiliar with its intricacies. The most notable risk is the extreme volatility of the market. Prices can fluctuate wildly within short periods, leading to potential losses that can be devastating if not managed carefully. For digital nomads relying on cryptocurrency as a primary investment vehicle, this volatility can pose a serious threat to their financial stability.

Moreover, the lack of regulation in the cryptocurrency space can be a double-edged sword. While it offers freedom from traditional financial institutions, it also means there is little protection against fraud, hacking, or other malicious activities. Digital nomads must take extra precautions to secure their digital wallets and transactions, as recovering lost or stolen cryptocurrency can be nearly impossible.

Additionally, the tax implications of using and investing in cryptocurrency can be complex, especially for digital nomads who may be subject to the tax laws of multiple countries. Navigating these regulations requires a solid understanding of both the legal and financial landscapes, which can be challenging without professional guidance.

Balancing the Pros and Cons: A Strategic Approach

For digital nomads considering cryptocurrency as part of their financial strategy, it’s crucial to strike a balance between the potential rewards and risks. Diversifying investments, rather than relying solely on cryptocurrency, can help mitigate the impact of market volatility. Utilizing stablecoins—cryptocurrencies designed to minimize price fluctuations—can also offer a more secure way to engage with the crypto market.

Staying informed and educated about the latest developments in the cryptocurrency world is another key strategy. The rapid pace of innovation in this field means that new opportunities and threats are constantly emerging. By keeping up with these changes, digital nomads can make more informed decisions and adjust their strategies as needed.

Finally, it’s important to consider liquidity—the ease with which assets can be converted to cash—when investing in cryptocurrency. Digital nomads often need quick access to funds, whether for emergency situations or spontaneous opportunities. Ensuring that some investments are easily liquidated can provide a safety net in times of need.

Embracing the Future of Finance

As the world continues to embrace digital transformation, cryptocurrency is likely to play an increasingly significant role in the financial lives of digital nomads. Whether it’s for transactions, investments, or simply as a hedge against the instability of traditional currencies, the potential of cryptocurrency is undeniable. However, as with any financial tool, it’s essential to approach it with caution, a clear strategy, and a deep understanding of the risks involved.

For digital nomads, cryptocurrency offers a unique blend of convenience, privacy, and investment potential. By carefully weighing the pros and cons, and staying informed about the latest trends, they can harness the power of cryptocurrency to enhance their financial independence and continue thriving in their nomadic lifestyle.

Related Post: How Web3 is Revolutionizing Remote Work for Digital Nomads

Further Reading:

- For a deeper understanding of how cryptocurrency works and its potential risks, visit CoinDesk.

- Learn more about managing taxes as a digital nomad dealing with cryptocurrency at Nomad Capitalist.

- Explore the latest in cryptocurrency security practices at CryptoSlate.